Welcome back. If you're just tuning in, we've been talking a lot about integration – particularly, integration of order management and execution management systems. For the past few years, we've all heard from traders complaining that their OMS and EMS solutions are falling short. The lack of cohesive workflows between the two systems have caused inefficiencies and delays to traders, while compliance officers have worried that their firms are trading blind. Well, as we wrote recently, that doesn't have to be true anymore. In fact, Spencer Mindlin of Aite Group recently declared in a white paper: “While the industry has debated the current and future state of OMS/EMS for 10 years… it was truly just a matter of when, not if."

So what's happened in that decade? There have been multiple imperfect approaches to integration; while these approaches have provided some value, none has achieved the value possible through a bonafide integration between best-in-class systems. Here are some of the most prevalent attempts we've seen in the marketplace.

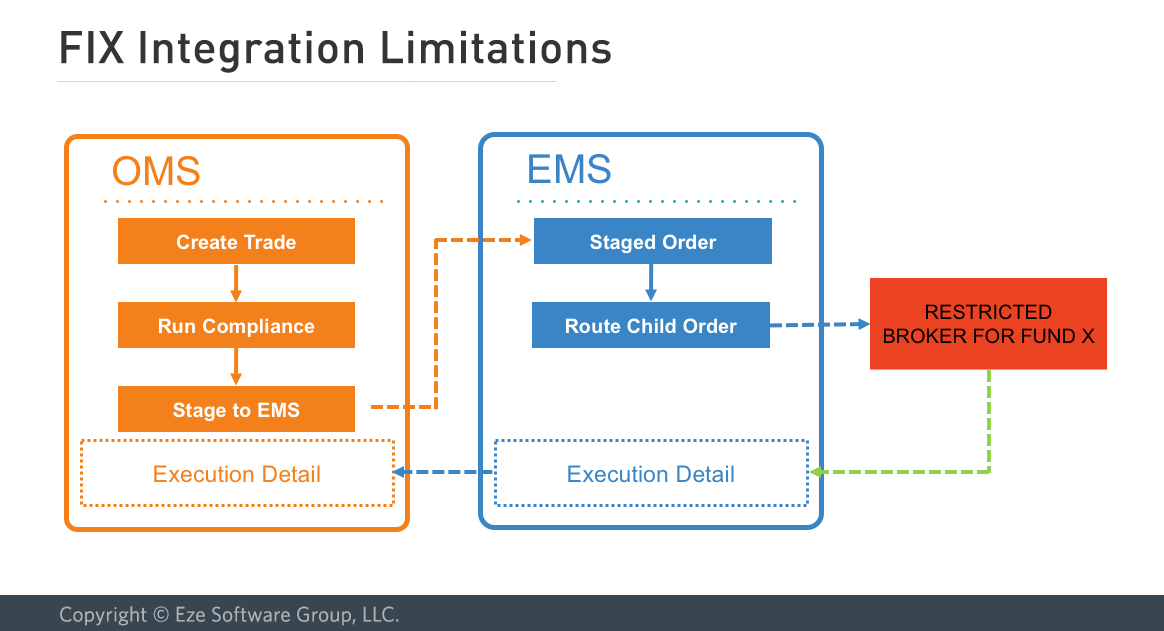

FIX-only integration: Most of you are familiar with this type of setup. You create an order in the OMS, run all your pre-trade compliance checks and do your allocations processing, then you stage an order via FIX to the EMS, at which point you use the EMS for order execution. The problem with this type of setup is the dreaded 'Swivel Chair' issue: you have two applications open on your desktop to complete one trade. If you have to change your order, you're swiveling back from your EMS to your OMS, rerunning all of your compliance checks, doing a cancel/correct out to your EMS system and executing from there. Not a very efficient workflow.

OEMS products: These products fall into one of two camps. Some are traditional EMS products that feature layered OMS-lite compliance functionalities such as firm-wide restricted lists or fat-finger rules but miss the more robust features, such as fund-specific exposure rules or global ownership disclosure checks. On the flip side, there are traditional OMS products with EMS-lite capabilities. These have rich compliance features and some EMS functionalities such as Level 2 data and a Watchlist, but more robust functionalities like enhanced list trading , pairs trading, or conditional orders aren't available. Neither of these scenarios has thus far been able to bring together best-of-breed functionalities in a truly integrated fashion.

One-Off Custom Solutions: These are specific integration scenarios where clients say, “I'd like to integrate System A with System B, I want to do it in the cheapest possible way and in the fastest time possible." These scenarios by definition are one-off attempts to stitch together two systems, so they don't easily adapt to changing needs or market conditions, and they ultimately become difficult to maintain over time.

A Better Way

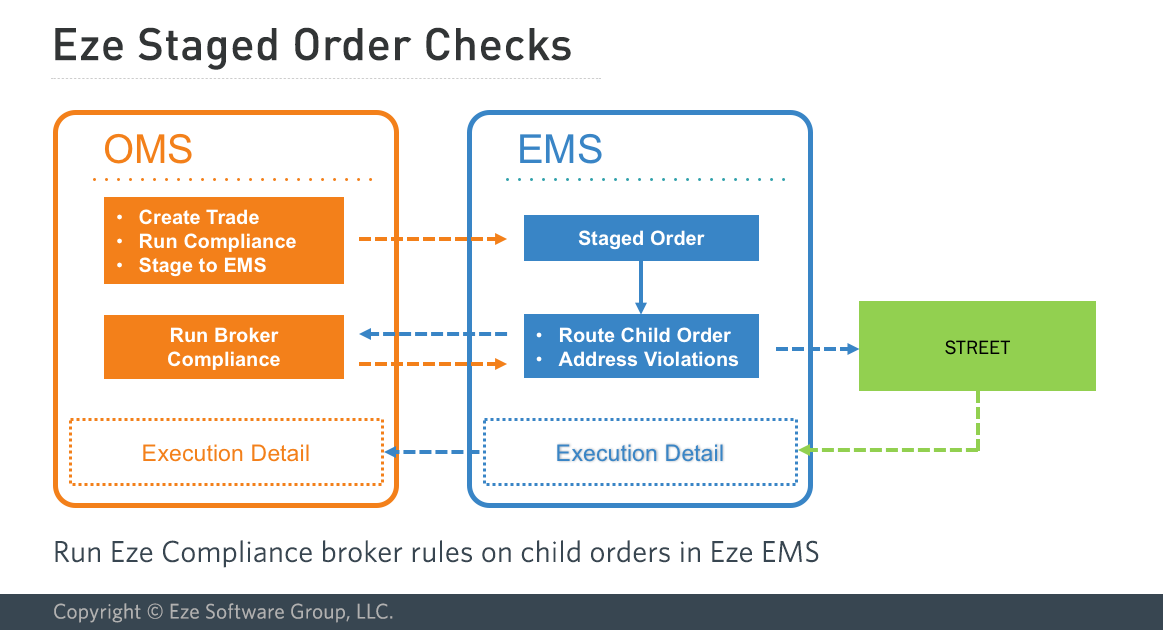

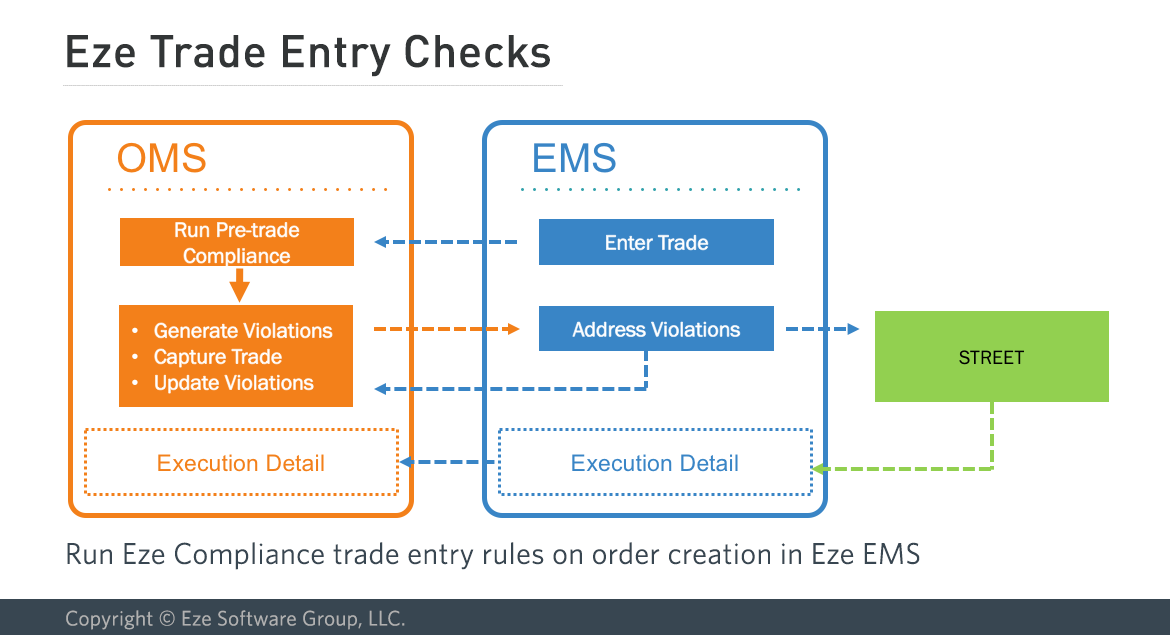

As we've written in the past, the time has come for a truly integrated solution. Past tendencies to employ multiple, niche EMSs across the firm had prevented true deep integration with the OMS due to cost and complexity. Now that the number of EMSs on a trader's desktop has shrunk, we believe the opportunity for a truly robust integration is here. Here's what a truly integrated EMS/OMS solution should feature:

- Streamlined order creation – the entire process from trade entry through execution should occur in one application with no swivel

- This means pre-trade and intra-day compliance and position checking should occur without the user having to leave the EMS

- Allocation scheme and strategy selection should also be accomplished without the user having to leave the EMS

- Data should be fully synchronized throughout the trade lifecycle without the user's intervention.

Here's how that works within our integrated solution:

Over the last year, we've truly seen our integrated solution resonate in the marketplace. In 2016, we've brought clients with USD118 billion in assets under management live on the integrated EMS/OMS, and have firms with another USD93 billion in the pipeline. The integration has resonated across trading, compliance and technology departments, reducing costs and optimizing workflows.

Why has this worked for us? For one, we own all of the source code, enabling a deeper, more seamless integration between systems and ensuring optimal workflow for all users. In the same vein, we've coordinated release cycles and development. Working as one unit allows us to ensure we're always working on the highest-priority integration initiatives, and can coordinate trouble-shooting and monitoring across a single support team.

Curious to learn more? For a preview of upcoming features and demonstration, check out Aite Group's white paper on the topic, and stay tuned for more exciting developments in 2017.

To stay up to date with our product development pipeline, strategic initiatives and other news, please subscribe.

To learn about Eze Software's award winning investment suite, please visit our applications page. To learn more about EMS/OMS integration within Eze Investment Suite, click here for an overview.